A combination of property taxes, sales taxes, and utility fee revenues fund basic public services and capital improvements in municipalities and counties throughout the CONNECT region. However, there is often a need to provide funding for more than just basic services and facilities. Within specific areas of a local jurisdiction, special needs may exist which require unique funding sources. Similarly, entire counties may wish to accelerate funding for facility improvements beyond what conventional revenue sources can pay for. In such circumstances, creative public finance techniques may be applicable. Tax increment financing is a way of capturing tax revenues generated within a specific district which exceed those generated in the year the district was designated, for use in promoting investment within the district. Special purpose taxing districts are districts where an additional tax is levied to pay for the facilities or services needed within the districts. Local option sales taxes are additional local sales taxes approved by referendum.

Why is this important to your community?

While a combination of property taxes, sales taxes, and utility fees fund most services and facilities provided by local governments, there may exist special funding needs unique to specific areas within a local jurisdiction. For example, a community may judge that the redevelopment of a blighted corridor will greatly strengthen the overall local economy, so much so that public investment is deemed to be a necessary incentive to catalyze the project. As another example, the expansion of transit to new areas may be best accomplished by creating a special tax district for those areas to be served by the expanded transit system. Both TIF and special purpose tax districts provide the means to pay for these localized facility and service needs without unfairly burdening taxpayers elsewhere in the jurisdiction. Local option sales taxes give counties the ability to accelerate needed infrastructure improvements by self-imposing a small additional tax on retail sales, a tool which is particularly attractive where sales are derived from those residing outside the local jurisdiction.

Where is it appropriate to use?

What priorities does it address?

What other tools are related?

How does it work?

Tax Increment Financing (TIF)

Tax increment financing is a public finance tool through which local governments (cities and counties) can finance public improvements with revenue bonds, stimulating private investment in new buildings and jobs and strengthening the tax base within a defined district. It is a “bootstrap” or self-finance mechanism because the bonds are repaid by the additional “increment” of tax revenue the private investment produces by expanding the tax base. Unlike more common general obligation, or G.O. bonds, TIF bonds do not require a public referendum and are not backed by the full faith and credit of local government, and therefore do not impact a local governments bonding capacity. TIF districts do not impose an additional tax burden. Rather, they assign revenues generated in a TIF district which exceed those generated in the year the TIF district was designated for use in promoting investment within the TIF district. Most often TIF districts have been applied in downtowns and other areas targeted for redevelopment and revitalization, where funds are used to acquire, clear, and assemble land for redevelopment, as well as to pay for improvement to streets and parking. TIF can also be used to spur development of undeveloped land, such as the use of TIF dollars to pay for streets and infrastructure in business and industrial parks, which increases the value of land and reduces the cost and risk to private developers.

Some 48 states have enabling legislation for some form of tax increment financing. Under Amendment One to the North Carolina Constitution, local governments are authorized to issue “private development financing” bonds for the purpose of providing public investments that will leverage private investment. Specific requirements include the creation of a development plan that is subject to state approval, as well as a prohibition on the use of TIF for funding basic public facilities such as police and fire stations. In South Carolina, TIF was made available in 1984 by an amendment to the South Carolina Code of Laws, and consequently has been utilized much more extensively than in North Carolina, with some 40 TIF districts in effect. In both states, TIF use is limited to areas meeting certain conditions, such as a demonstration of the existence of “blight” or other impediments to private investment. Other factors that vary by state include the use of powers of eminent domain for property acquisition and provisions for the concurrence of all governmental entities, or waiving the application of TIF for certain entities such as school districts.

Special Purpose Tax Districts

Within most local government there exist areas where there are demands for public services and facilities that are not required elsewhere. Examples include a rural hamlet in where there are needs for fire protection, solid waste disposal or recreational facilities, or a downtown where merchants wish to establish a Business Improvement District (BID). To fund services and facilities unique to specific districts, local governments are authorized to create special purpose taxing districts (also known as municipal service districts, special assessment districts, or special benefit taxing districts), where an additional tax is levied to pay for the facilities or services needed within those districts. Typically, such districts are created following a referendum among the voters and property owners within the district to consent to the additional tax levy.

Local Option Sales Tax

Counties in North Carolina and South Carolina are permitted by state law to create an optional additional local sales tax to fund expenditures in infrastructure beyond what can be funded by property taxes and other conventional sources. In South Carolina the additional tax can be up to one penny (1 percent), while in North Carolina the additional levy is limited to one-quarter of a penny (0.25 percent). Local option sales taxes are approved by a local referendum, and are typically used to fund road improvements and public transit.

Resources

- Tax Increment Financing in North Carolina, University of North Carolina School of Government

- Tax Increment Financing: Tweaking TIF for the 21st Century, Urban Land Institute

- Tax Collection in Special Districts, University of North Carolina School of Government

- FAQ on Local Option Sales Tax, North Carolina Association of County Commissioners

Ready to get started?

Using the Tool

Tax Increment Financing Specific provisions, limitations, and protocols for establishing TIF districts vary from state to state, however these are the basic steps which most local governments must follow to establish TIF districts.- Establish the Need for Development / Redevelopment This initial step may include a documentation of existing conditions that demonstrates a need for private investment in redevelopment, including such factors as blighted and vacant properties, antiquated or non-existent infrastructure, poorly configured properties and crime.

- Create a Plan for Development Redevelopment Redevelopment plans typically include a market analysis for proposed uses, the designation of redevelopment project sites, estimates of the cost to assemble land and make necessary capital improvements and projections of estimated tax increment revenues as the basis for determining bonding capacity.

- Designate a TIF District The date of TIF district designation establishes the “base year.” The amount of revenue generated in the TIF district in the base year will continue to be assigned to local government entities without regard to future growth of the district tax base. TIF district designations may be subject to the approval the county, state or other units of government.

- Local Government Carries Out Redevelopment Activities Following the issuance of bonds, redevelopment activities may include property acquisition, clearance and assembly, the construction of capital improvements and the sale of land to one or more private developers who commit to develop property in accordance with the redevelopment plan and other contractual provisions.

- Private Development Occurs TIF district and redevelopment area designation may extend as long as 30 years, during which redevelopment of new buildings will increase the property tax base, the “increment” of which is allocated to amortize the TIF bonds.

- Identify the district to be served.

- Estimate capital or service delivery costs for the capital improvements and/or special services needed within the district.

- Determine the additional tax revenue required to amortize bonds and/or fund annual operating expenses within the district.

- Conduct surveys within the district to measure support for the district and the associated additional tax.

- Local government local body notifies all property owners and voters within the district of a public hearing to consider a public referendum to approve creation of the special district.

- Upon approval of the referendum, create an operating entity as authorized under state law and issue bonds to construct public improvements within the district.

- Create a county-wide capital improvement program for the facility type (typically roads) to be funded by the local option sales tax.

- Identify costs of needed facilities that cannot be funded by available tax or other revenue sources.

- Estimate revenues which could be made available with the optional sales tax.

- Identify capital projects that could be funded with the additional revenue.

- Identify public benefits of the needed improvements (jobs created, congestion reduced, safety improvements).

- Establish public support among local municipalities and business and civic organizations (chambers of commerce, neighborhood associations).

- Adopt a local government ordinance or resolution calling for the imposition of the additional sales tax.

- Hold a referendum among county voters to approve the additional sales tax.

- Upon approval, issue bonds to pay for the identified capital improvements.

Partners

- Developers

Where has it worked?

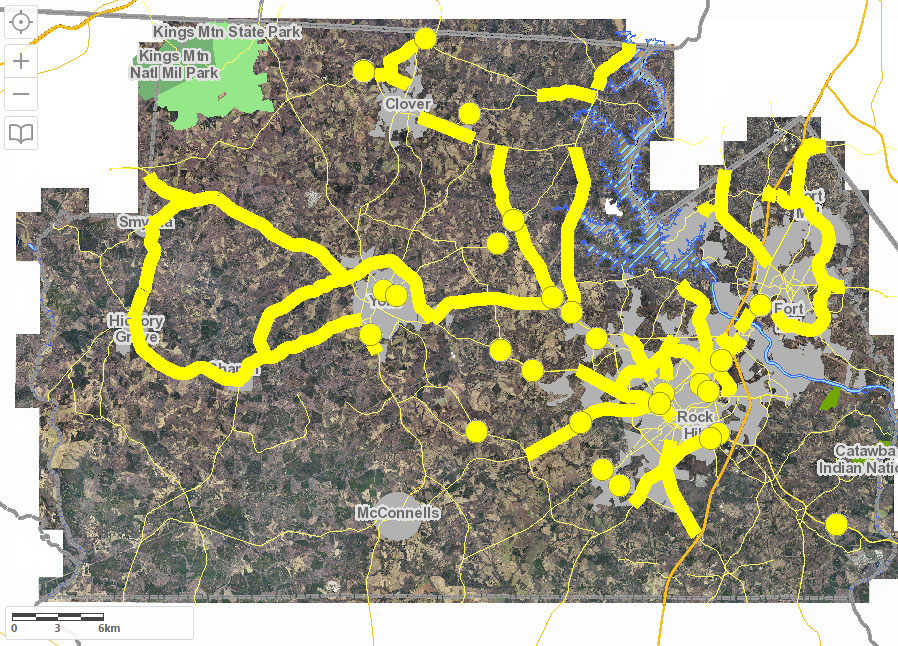

Pennies for Progress - York County, SC

Image Source: York County.

Image Source: York County.

Contact

Jim Gaddy or Phil Leazer, Program Managers

803-684-8571

engineering@yorkcountygov.comAbout the Program

In 1997, voters in York County approved the first local option sales tax in the state of South Carolina, termed the Capital Projects Sales and Use Tax. With rapid growth fueled by its proximity to Charlotte coupled with dwindling state funding for road improvements, York County was experiencing ever increasing levels of traffic congestion and compromised traffic safety. To date over $545 million has been raised to widen and extend both state and county roads, as well as I-77, alleviating congestion and improving the connectivity of the road network. The 7-year optional sales tax periods have been extended twice by voters, most recently in 2011 when the referendum passed by an overwhelming 82%.

Why it works

Typically taxpayers have little direct say in the taxes they pay and the uses of tax money. Local option sales taxes allow voters to decide local spending priorities to address capital needs. In addition to accelerating improvements to transportation and other infrastructure, they leverage millions of dollars in additional state funding and are supported by non-local residents including tourists and other visitors who make local retail purchases.

Horizon Tax Increment Finance District - Charleston, SC

Image Source: Horizon Project Foundation.

Image Source: Horizon Project Foundation.

Contact

Michael Maher, CEO, Horizon District Foundation, Inc.

843-958-6416About the Program

The City of Charleston has continued to be a model of urban revitalization, successful in part because of the use of tax increment finance in areas targeted for revitalization or redevelopment. Most recently the city created a Tax Increment Financing (TIF) district for transformation of a 20-acre former landfill into a vibrant mixed-use center and a center for the biotechnology industry, linked to the medical research at the adjacent Medical University of South Carolina (MUSC). With 3,000 new dwellings along with commercial uses and a hub of high-paying jobs, the Horizon Project will utilize $250 million in TIF-funded bonds to leverage $750 million in private investment, and bring to productive use land that would continue to be a fallow blighting influence. The Horizon Project Foundation is a nonprofit entity created as a joint venture of the City of Charleston and the Medical University of South Carolina

Why it works

Tax increment financing has been shown to be one of the most effective means of promoting revitalization and the reversal of blight where there are major impediments to private invest due to the existence of blighted conditions, site contamination, or antiquated infrastructure. By utilizing future increased tax revenues created by private investment to fund upfront public investment, tax increment finance leverages revitalization to occur with no increase in tax rates.